Two years old!! HQM Rapid Market System Further Upgrade

Time:2020-11-17 00:00

HQM Extreme Speed Market System is two years old! !

The HQM speed market system has been launched in China Merchants Securities and has been running stably for 2 years, and it has been launched in Haitong Securities and has been running stably for 1 year. The number of institutional users who have used the system has reached 30+. In the past two years, the HQM system has continued to provide customers with high-quality market services, and has established a good reputation in the industry.

In the programmatic trading process of securities, profit opportunities are fleeting, and "low latency" is one of the important goals pursued by traders. Market data is the basis for trading strategy execution, and obtaining high-speed and low-latency market information is a prerequisite for seizing market opportunities.

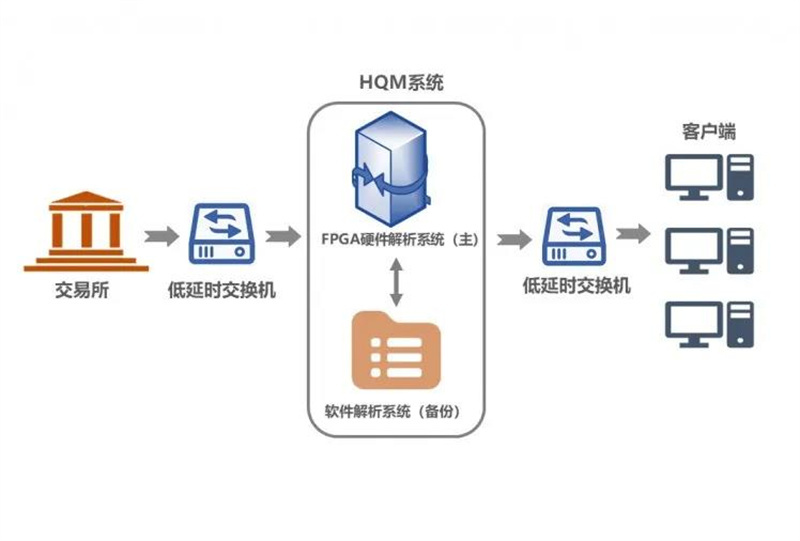

Huayun independently developed a new generation of FPGA-based high-speed, low-latency market system - HQM hardware market acceleration system, which supports Shanghai and Shenzhen stock market, including science and technology innovation board, options and other sectors. The system provides customers with multiple market access methods and forwarding methods. For example, market mirroring access and standard TCP access are supported on the access side, which can meet the needs of brokers in different scenarios. Support UDP multicast forwarding and standard TCP distribution on the user side. For users who have high requirements for low market delay and high data security, TCP distribution can be used to ensure the safety and reliability of the market.

During the market transmission process, the HQM system obtains the original market data from the exchange market gateway, and after the HQM system analyzes and reorganizes, it forwards it to the client server through a low-latency network.

The system implements data analysis functions such as market snapshots, index snapshots, order-by-order orders, order-by-order transactions, and order queues .

Large throughput: Shanghai stock market peak 2 million transactions per second

Shenzhen peak 3 million transactions/second

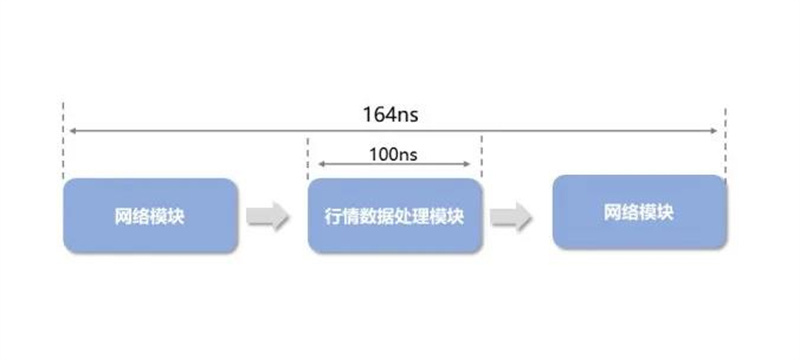

Performance advantage: nanosecond-level real-time analysis and real-time response

High Availability: Supports seamless switching of active and standby quotes

The market is the questioner

Huayun is the answerer

The user is the final judge.

We will continue to work hard to give users more perfect answers!

Related News